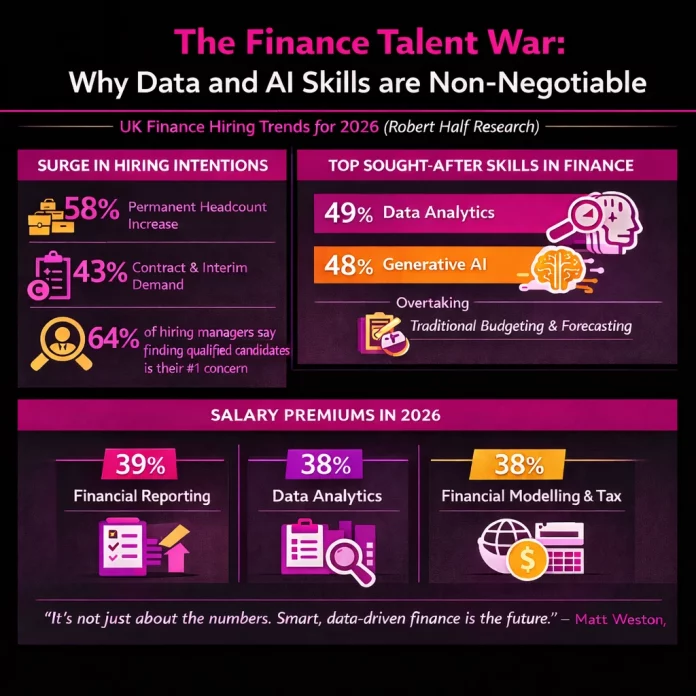

The UK finance talent function is currently reaching a critical crossroads. According to latest data from Robert Half, the sector is witnessing a massive surge in hiring. However, there is a catch. The traditional accountant is quickly being replaced by a “data-first” professional. Consequently, the shortage of these specific skills is driving salaries to record premiums.

Finance Talent Hiring Intentions Hit a New Peak

Finance and accounting are now outpacing almost all other white-collar fields. Specifically, the research reveals a major uptick in recruitment appetite. For instance, 58% of employers plan to increase permanent staff levels soon.

Furthermore, 43% of firms are turning to interim professionals to plug immediate gaps. Despite this appetite to grow, 64% of hiring managers remain deeply concerned about finding qualified candidates in 2026.

The New “Must-Have” Skills

The days of finance being a purely retrospective function are over. Instead, businesses are accelerating modernisation.

This shift has moved demand toward professionals who can merge technical rigour with predictive power. In fact, for the first time, Data Analytics and Generative AI have overtaken traditional budgeting as the most sought-after competencies.

The Cost of the Gap

Because these hybrid skills are in such short supply, employers are prepared to pay a premium. Specifically, areas like Financial Reporting and Business Intelligence tools are most likely to command higher pay. As a result, businesses are placing immense value on those who can support strategic decision-making through advanced tools.