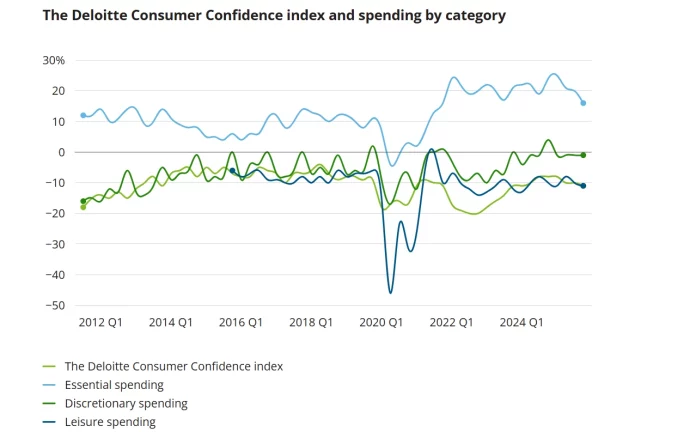

While retail headlines are currently fixated on the “frugal consumer,” the real story for The Growth Hub audience is the inevitable downstream impact on B2B supply chains. According to Deloitte’s latest Q4 Consumer Tracker, confidence has plummeted to a two-year low of -11.1%.

For manufacturing sales teams, this is a leading indicator of a “Cascade Effect.” When 39% of consumers shift to defensive spending, the businesses serving them will inevitably follow suit, negotiating harder, delaying capital investments, and scrutinizing every supplier contract in Q1 2026.

The Cascade Effect: From High Street to Factory Floor

The drop in confidence isn’t just a “retail problem.” It operates as a strategic warning for B2B performance because purchasing decisions flow directly from end-market demand. We anticipate three primary shifts in buyer behaviour over the next 6–8 weeks:

Renewed Budget Scrutiny: 30% of consumers reporting less money directly correlates with reduced capital budgets for the firms that serve them. Projects previously “approved in principle” are now at risk of postponement.

The Loyalty/Value Pivot: As 31% of consumers hunt for discounts, corporate procurement departments will mirror this behaviour, demanding volume discounts or extended payment terms that weren’t on the table six months ago.

Competitive Churn: 27% of shoppers are switching brands to cut costs. Expect your existing B2B clients to shop around similarly, creating a high-risk environment for incumbents but a major opening for “challenger” suppliers.

Sector Exposure: Where is the Pressure Highest?

Not all manufacturing sectors will feel the squeeze at the same time. We’ve mapped the “Squeeze Timeline” for 2026:

- Immediate Pressure: Retail suppliers, consumer goods manufacturers, and hospitality fit-out contractors.

- 3–6 Month Lag: Industrial equipment for consumer goods, commercial property management, and professional business services.

- Indirect Impact: Heavy industrial manufacturing and infrastructure. While less exposed, these sectors will still face finance-led demands for cross-functional cost reductions.

- Growth Hub Verdict: Stop the ‘Feature-Benefit’ Pitch

When clients operate under margin pressure, they don’t care about “innovation” as much as they care about cash preservation. To protect your pipeline, your sales team should adopt these three tactics immediately:

- Lead with ROI and Payback: Feature-heavy selling is dead in a frugal climate. Quantify exactly how your solution saves money or improves efficiency within a specific timeframe.

- Weaponise Flexibility: Offer milestone-based billing or performance guarantees to reduce the perceived risk for cash-strapped buyers.

- The “Early Warning” Discovery: Don’t wait for a “budget constraint” objection. Ask your prospects: “How are your sales volumes tracking versus last year?” or “What is driving your cost-reduction targets this quarter?”

Consumer caution is a precursor to corporate caution. As Deloitte’s data proves, the spending climate is toughening. The winners of Q1 2026 will be the sales teams that stop acting as transactional vendors and start acting as strategic partners helping their clients survive the squeeze.